giovedì 27 aprile 2017

mercoledì 26 aprile 2017

Borsa Usa, un altro fondo ribassista è finito in trappola

26 aprile 2017, di Daniele Chicca

La stessa dinamica rilevata durante il rally della Borsa Usa a febbraio è tornata in gioco ieri. Una puntata multi miliardaria short (da 17 miliardi di dollari circa) sull’S&P 500 finita male ha contribuito al balzo dell’azionario a inizio 2017. Si tratta di una strategia, tornata in auge ieri, che prevede la vendita allo scoperto di diverse opzioni call sul listino azionario.

Sembra, come riferisce Charlie McElliggott, Managing Director e Head of US Cross-Asset Strategy di RBC Capital Markets, che “siamo nuovamente di fronte a un fenomeno analogo”, con un altro fondo rimasto intrappolato nel gioco degli “short gamma”. Essere “short gamma” significa in breve comprare sui massimi e vendere sui minimi. A febbraio il malcapitato era stato il fondo Hedged Futures Strategy di Catalyst Fund, finito nei guai non appena il paniere allargato della Borsa americana ha superato un livello tecnico cruciale (2.300 punti).

Le scommesse ieri si sono viste sui livelli di 2.330 e 2.370 punti dell’indice allargato, ma tutto si dovrebbe decidere nell’area di 2.400. Il mercato scoprirà presto qual è il livello di perdita massimo che il fondo in questione è in grado di assorbire, con l’indice S&P 500 che a breve è visto salire fino ai 2.400 punti se non ancora più su. I primissimi scogli da tenere d’occhio oggi sono a quota 2.380/85 punti.

Ma il vero livello spartiacque è quello di 2.425/2.450 punti. Una violazione al rialzo di tale trading range, che sarebbe anche equivalente a un nuovo massimo storico, comporterebbe rischi ingenti per chi è andato “short gamma”, un’operazione che viene effettuata nella convinzione che la Borsa si indebolirà.

Il fondo in pratica cede il diritto di comprare il sottostante al prezzo di esercizio prestabilito (strike price) prima di una certa data, allo scopo di ricevere in cambio il premio che viene accreditato sul conto del venditore la seduta successiva all’apertura della posizione sul mercato delle opzioni.

Il problema per Wall Street, come osserva McElligott, è che il balzo della Borsa è “estremamente tecnico al momento”, sostenuto dalle puntate sopra citate oltre che da qualche fattore esterno. Le trimestrali societarie positive non hanno fatto che alimentare la sensazione pericolosa che vada tutto bene e che i rialzi di mercato siano giustificati.

Questa sensazione di compiacimento e il balzo per ragioni “tecniche”, aveva avvertito lo strategist a febbraio, rischiano di “mandare un segnale falso che ha il potenziale di attirare altri acquisti” nonostante i valori eccessivamente alti della Borsa americana indichino che convenga restare prudenti. È possibile che si stia creando una sorta di bolla, aprendo uno scenario “in cui il mercato rischia di collassare sul suo stesso peso“.

Oggi per la prima volta in assoluto la capitalizzazione della Borsa Usa ha toccato i massimi a $50mila miliardi.

martedì 25 aprile 2017

venerdì 21 aprile 2017

giovedì 20 aprile 2017

mercoledì 19 aprile 2017

martedì 18 aprile 2017

lunedì 17 aprile 2017

domenica 16 aprile 2017

giovedì 13 aprile 2017

martedì 11 aprile 2017

lunedì 10 aprile 2017

sabato 8 aprile 2017

giovedì 6 aprile 2017

mercoledì 5 aprile 2017

martedì 4 aprile 2017

Eyeing Stock Market Disconnect As Optimism Blocks Bears

Bears have taken numerous shots yet the bulls have consistently blocked them all. The S&P 500 (via SPDR S&P 500 (NYSE:SPY)) is barely off its all-time highs and has survived all number of setbacks. These setbacks seem to get more and more shallow.

Monday, April 3rd, 2017 delivered another classic example. The morning began with very convincing selling. It looked like big money was finally ready to lock in profits and retreat. The S&P 500 (SPY) followed through on Friday’s wickedly weak close in a move that looked like it confirmed the short-term downtrend and the downtrend from the 20-day moving average (DMA). Yet, once again, the sellers failed to seal the deal as buyers roared back. The index just missed touching its 50DMA uptrending support.

Buyers fail to challenge two parallel downtrends, yet sellers fail to maintain their advantage. The S&P 500 recovered sharply off its low of the day to close near flat.

The 5-minute chart of the S&P 500 reveals how sellers took a break for lunch (East Coast time), and, I guess, did not bother to return to their trading desks…

The volatility index, the VIX, was the exclamation point on the failure of the bears to hold the advantage. The VIX soared as much as 9.9% before completely imploding. The VIX quickly went from confirming Friday’s hint of sudden fear to confirming the stubborn resilience of the “bargain shoppers.”

Another classic implosion for the volatility index, the VIX.

Monday's action sent me back to an interesting interview on Nightly Business Report, last week on March 30th, with stock market psychologist Dr. Doug Hirschhorn. Dr. Hirschhorn discussed the psychology of a market whose exuberant confidence is disconnected from “reality.” The lead-in from the transcript:

“And while GDP and other economic data are meddling along, indicators that measure optimism are soaring. Take consumer confidence – just the other day, we told you that it stands at the highest level since all the way back in 2000. And there’s margin debt, the amount of money borrowed to buy stocks. It’s an all time high, and that means investors are feeling pretty optimistic about the prospects for the market.”

For those of us accustomed to the market’s forward-looking behavior, we can easily explain this “disconnect” as traders and investors looking forward to a day that is better than today. However, Hirschhorn took his explanation down another level of sentiment. He explained that the market is experiencing the same thing in sports when a new coach comes to town: aspirations abound and hope freshens about the difference change will bring.

However, Hirschhorn claimed that the new coach (aka President Donald Trump) is still working with the same team (the economy). I think this particular analogy is a bit extended: even through an abundance of executive orders, Trump and his team do have enough power to at least alter the contours of the American (and even the global) economy.

Regardless, Hirschhorn made an even stronger claim that Trump’s charisma is charming the market into an obedient optimism:

“I refer to this as the Jedi mind trick. President Trump, it isn’t a political conversation, but he’s charismatic, he’s engaging, he uses great compelling words like fantastic and great and wonderful. And those words stick in our minds, and then we move forward with that analogy in our head.”

Whether or not you agree with Hirschhorn’s characterization of the market set-up and psychology, I think his advocacy for independent thinking as a way to ward off the market’s snake charms should resonate. I think the following statement is a key point of advice for surviving the influence of market psychology (emphasis mine):

“…go back to the data and the best thing you can do is to recognize that you are having this over anxious or overconfident feeling, and then go back to data points and look for pros and cons, break it down to an objective list of pros and cons. Another great tool you can use is, look at who you are having conversations with, what chat rooms or blogs you are reading. And so, if you are surrounding yourself with like minded people, that is a red flag that you lost objectivity in what’s going on around you.”

Regular readers know that my favorite tool is AT40 (T2108), the percentage of stocks trading above their respective 40DMAs. When my favorite technical indicator is at its best, it flags overbought and oversold extremes which help mark the ends of rallies and sell-offs respectively. Right around the moment I might be tempted to get overwhelmed by the sentiment of the moment, AT40 helps me think more independently.

Right now, AT40 is not flagging an extreme in optimism. I even just flipped to “cautiously” bullish. At the time, I acknowledged that I was pushing things a bit given the S&P 500’s short-term downtrend remained intact and the index has not quite reversed the big sell-off day. The S&P 500’s bounce off 50DMA support helped convince me to commit to a more bullish case…even if it turns out that the market is finally ready to sell into oversold territory.

One additional signal that DOES have me worried about the bull is the Australian dollar (NYSE:FXA) versus the Japanese yen (NYSE:FXY). AUD/JPY never recovered intraday along with the stock market. At the time of writing, AUD/JPY continues to sell-off and is at a 5-month low. I think this move confirms a top in AUD/JPY and puts its 200DMA support into play. I will be watching closely to see whether the market continues its loose correlation with my favorite indicator from forex.

The Australian dollar versus the Japanese yen confirmed a top with this lower low. The 200DMA line of support is now in play. The outstanding question is whether this weakness also flags more coming weakness for stocks.

In the meantime, I will do my best to avoid getting seduced by the market’s near uncanny resilience and the consistent failure of sellers to mount a serious threat to the thesis of the buyers and optimists.

lunedì 3 aprile 2017

domenica 2 aprile 2017

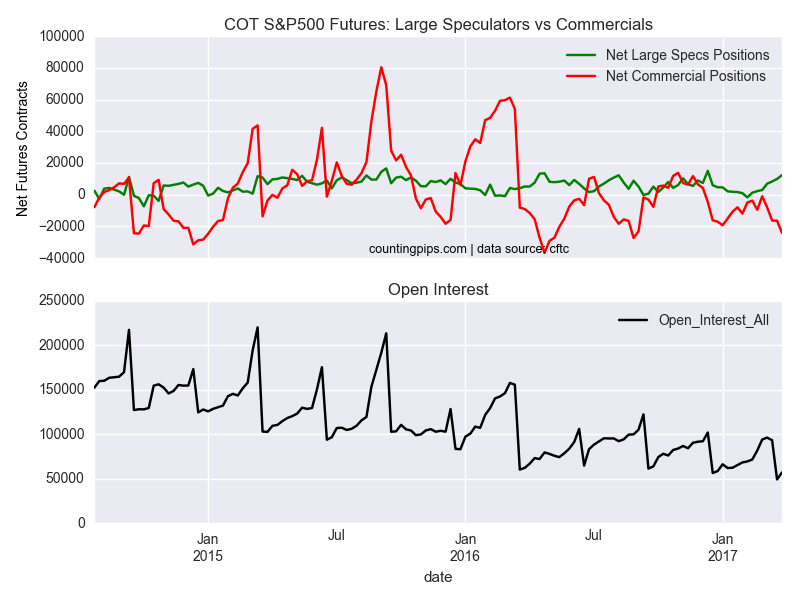

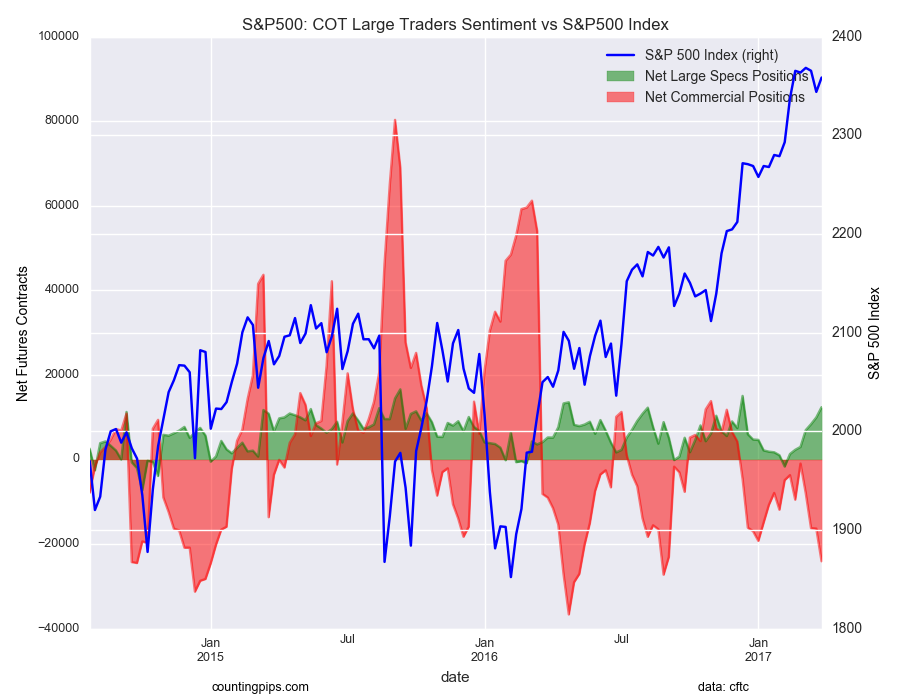

Large S&P 500 Speculators Pushed Bullish Net Positions Higher

S&P500 Non-Commercial Positions:

Large speculators continued to increase their bullish net positions in the S&P500 stock futures markets last week for the seventh straight week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of S&P500 futures, traded by large speculators and hedge funds, totaled a net position of 12,370 contracts in the data reported through March 28th. This was a weekly gain of 2,427 contracts from the previous week which had a total of 9,943 net contracts.

Speculative positions are now at their highest level since December 13th when net bullish positions equaled +15,031 net contracts.

S&P500 Commercial Positions:

Meanwhile, the commercial traders position, categorized by the CFTC as hedgers or traders engaged in buying and selling for business purposes, raised their bearish positions for a fourth week to a total net position of -24,081 contracts last week. This is a weekly change of -7,718 contracts from the total net of -16,363 contracts reported the previous week.

S&P500 Stock Market Index:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the S&P500 index closed at approximately 2,358.57 which was a rise of 14.55 from the previous close of 2,344.02, according to market data.

Emini: April Government Shutdown Crisis And 5 Per Cent Correction

Monthly S&P 500 Emini futures candlestick chart:

Buy climax at Final Bull Flag measured move target

The monthly S&P 500 Emini futures candlestick chart had a bear body this month after last month’s big bull bar. Yet, the bar was a doji bar, and therefore a weak sell signal bar after a 4 bar rally.

The monthly S&P 500 Emini futures candlestick chart has rallied strongly for 15 months. In addition, it was especially strong for the past 4 months. This month was the 1st bear bar in 5 months. Because it closed near the middle and not near the low, it is a low probability sell signal bar. Hence, there are probably buyers below its low. Therefore, a reversal down would probably be minor, even if it lasted a few bars (months). As a result, the best the bears will probably get is a pullback into a bull flag.

Final Bull Flag

The Emini was in a trading range for more than 20 bars in 2014 and 2015. Since that was late in a bull trend, it was probably the Final Bull Flag. Bulls therefore take profits around a measured move up. The March high was at a measured move up. Therefore the location is good for a major top on the monthly chart.

Yet, a major top needs some selling pressure. A 15 bar tight bull channel usually has to transition into a trading range before it can reverse into a bear trend. Therefore, the bears will need at least a micro double top before they can create a major reversal. Hence, the downside risk is small over the next 2 or 3 months.

When there is a Final Bull Flag reversal, the target for the bears is the bottom of the Final Flag. That is around 1800. How long would it take to get there? It might take 10 – 20 bars, which is 1 – 2 years. There is no sign of a reversal yet. However, if the bears begin to create a strong reversal, 1800 would be their target.

Bears need micro double top

A micro double top on the monthly chart is a small double top on the weekly chart and a big double top on the daily chart. Hence, a micro double top can sometimes lead to a major reversal. Therefore, traders will watch what the market does after it pulls back and then tests the March high. If there is a strong sell signal bar in May or June, the bears will have a better chance of a major reversal.

Weekly S&P 500 Emini futures candlestick chart:

Strong reversal up after last week’s bear breakout

The weekly S&P 500 Emini futures candlestick chart had a big bull trend bar this week after the prior week’s strong bear reversal down from measured move targets.

The weekly S&P 500 Emini futures candlestick chart reversed down strongly after a micro double top at the measured move up from a 2 year trading range. Yet, the bulls reversed the Emini up even stronger this week. This week is therefore a buy signal bar for a High 2 bull flag. Since the weekly chart is still Always In Long, bulls can buy above this week’s high.

But, this week’s bar was big. Therefore, the stop for the bulls is far below. Hence, the risk is big. In addition, the bulls are buying close to the top of a 5 week tight trading range. Furthermore, this is at the resistance of a measured move target.

As a result, this is a low probability buy setup. When the probability is low and the risk is big, there are usually more sellers than buyers above the buy signal bar. Therefore, sideways is more likely than up.

Weekly buy climax

The 5 month rally has been exceptionally strong. Yet, the March high was unusually far above the weekly moving average. That means that the rally is unsustainable and climactic. As a result, many bulls will wait to buy a pullback.

If you look back at the weekly chart to find times when it was far above the moving average, more than 70% pulled back to the moving average before going much higher. Therefore, even though this week is strongly bullish, the context is bad. The odds are that the Emini will work sideways to down to the moving average before it rallies much higher.

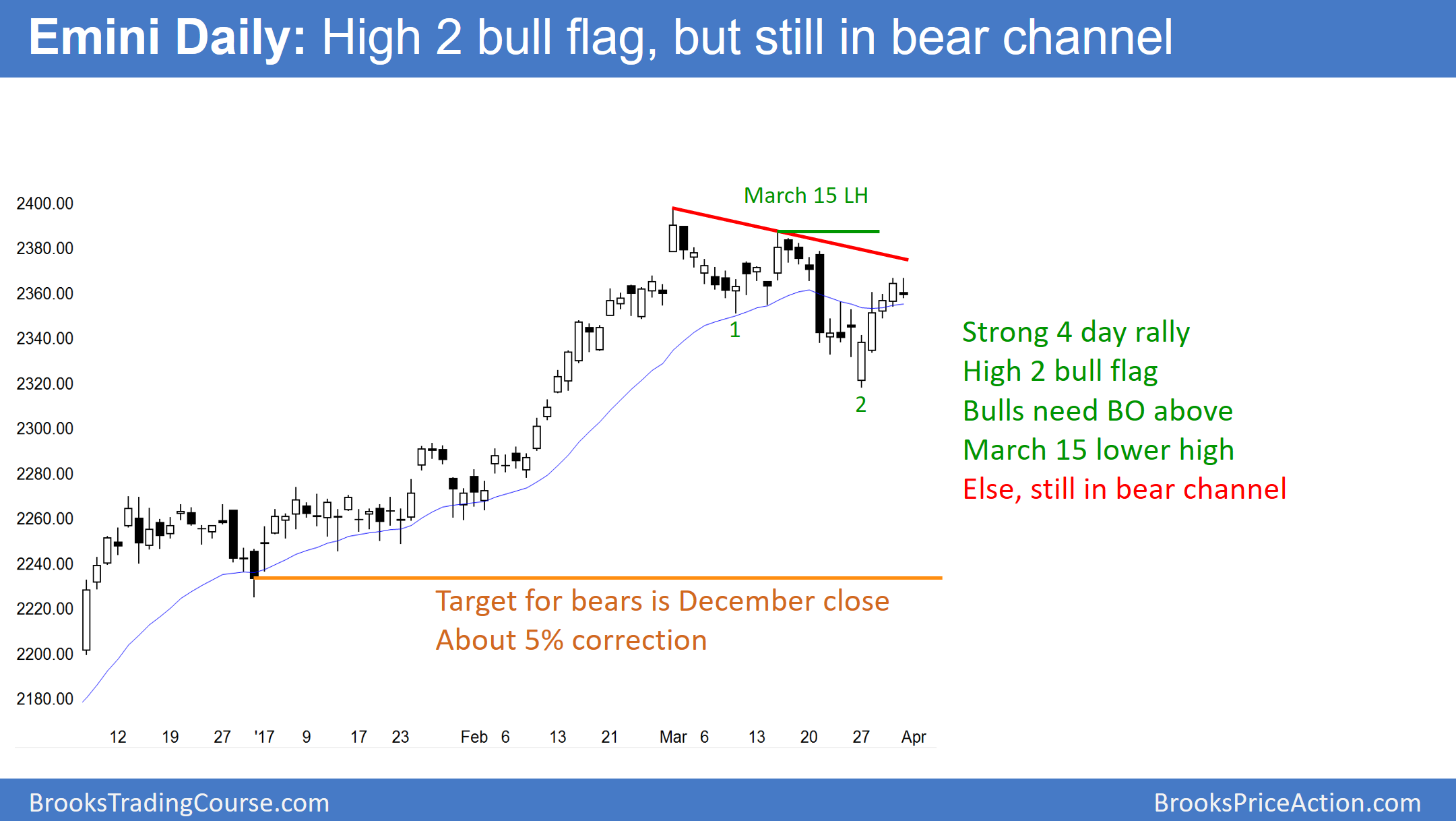

Daily S&P 500 Emini futures candlestick chart:

Bear rally?

The daily S&P 500 Emini futures candlestick chart had 4 consecutive bull bars this week after reversing up from a failed bear breakout. Since it still has a lower high, it is also in a bear channel.

The daily S&P 500 Emini futures candlestick chart is in a bull flag and an early bear trend. Traders therefore need more bars to determine the direction of the next couple of months. The momentum up favors the bulls. Yet, the Emini reversed down from a measured move target on the monthly chart. Furthermore, there is a buy climax on the weekly chart. In addition, the reversal down has not yet reached the weekly moving average. Therefore, there is resistance above and a magnet below.

While the bulls got a strong reversal up this week, they need a strong breakout above the March all-time high. Without that, the odds favor sideways to down over the next few months.

Broad bear channel

The bears had a strong bear breakout 2 weeks ago. Since the rally is still below the high of 2 weeks ago, and the Emini also has a lower low, the Emini is in a bear channel. Yet, the bears were unable to create follow-through selling.

Most noteworthy is that the bulls reversed the market up strongly. When a market is in a bear trend, it often has rallies that are strong enough to reverse the market to Always In Long. However, if a rally fails to get above the most recent major lower high, it is still just a rally in a bear channel.

Trading range so both bull and bear setups

Since the Emini has been in a trading range for 2 months, it is neutral. There are always good reasons to buy and to sell when the market is in a trading range. As a result, the bulls and bears are balanced, and the market can continue sideways for a long time.

The buy climax on the weekly chart was unusually extreme. In addition, it was at a measured move target on the monthly chart. Furthermore, the Emini never tested the close of last year. Consequently, the probability slightly favors the bears.

April government shutdown crisis and 5 per cent correction

The next major catalyst for a breakout up or down is the congressional fight over the continuing resolution that expires on April 28. While news is only a catalyst, it can be the start of a big move. Since the odds favor a 5% correction, a fear of a government shutdown is a reasonable catalyst. Because March and April tend to be bullish, the stock market might stay in its trading range until the end of April.

Black Swan rally?

Whenever there are good reasons for a selloff, traders need to be aware of Black Swan events. This is a low probability outcome. Here, that would be a strong breakout to a new all-time high.

When a low probability event happens, traders are trapped. If there is a strong bull breakout, bulls will be trapped out because they see the market as too high to continue. Bears get trapped in because they are selling the breakout. If the rally continues, trapped bulls and bears are forced to buy. Bears continue in denial and keep selling, expecting a top. Bulls are in denial as well and keep scalping out. Both bulls and bears repeatedly have to buy. As a result, the rally can go much further up than what seems reasonable.

Will this happen? I said that this would be a Black Swan. Therefore, by definition, it is very unlikely. Yet, if it begins to happen, traders should not deny it. They should buy and hold for a swing up.

sabato 1 aprile 2017

Iscriviti a:

Commenti (Atom)