Knowing the exact price level that stocks will turn is unknowable.

(It sure is fun to try, though.)

We may not be able to predict the size of the selloff, but we can predict its shape.

A Quick Primer

Technical Analysis Has Two Parts

First, you have supply and demand of an asset. Are there more buyers than sellers? Are there more sellers than buyers?

The second part is liquidity. Are market participants sitting on the bid and offer? Or is the demand for liquidity so high that are investors are trying to sell at any price?

Right now... well, it's obvious. There are more sellers than buyers, and there is massive demand for liquidity.

The Economy Takes a Back Seat

We can talk bailouts and unemployment numbers all day. What matters right now is a liquidity crunch that's breaking every single asset class.

Funds are getting crushed. They walked into 2020 with a hilarious amount of leverage, and things went haywire.

Generating alpha from short vol? Blown out.

Merger arb? Smoked.

Credit? Complete crash.

Risk Parity? Aged like milk.

Merger arb? Smoked.

Credit? Complete crash.

Risk Parity? Aged like milk.

The treasury market went nuts. 30 year had its largest rally and selloff in the same week. There's talk of sovereign entities needing to convert debt to dollars to make it out of the COVID crisis.

The market isn't reacting to COVID numbers, or even how bad earnings will be. It's forced liquidations. This is, by definition, an irrational market response.

Once these overleveraged knuckleheads clear out, then this is where things get interesting.

The One Thing That Will Bottom This Market

I have a trade setup called the “bathwater trade.” It’s when a company has been in a severe, sustained downtrend, and then they release awful news.

They throw the baby out with the bathwater.

The best example was from the 2018 bear market. AAPL had been sucking (very technical term) for a few months.

Then the company guides down and warns on earnings.

That leads to an exhaustion gap lower… and that was it.

Markets don’t selloff when the bad news it was expecting finally arrives. They selloff in anticipation of the bad news.

(The same happens during rallies, too. Ever heard of “buy the rumor, sell the news?”)

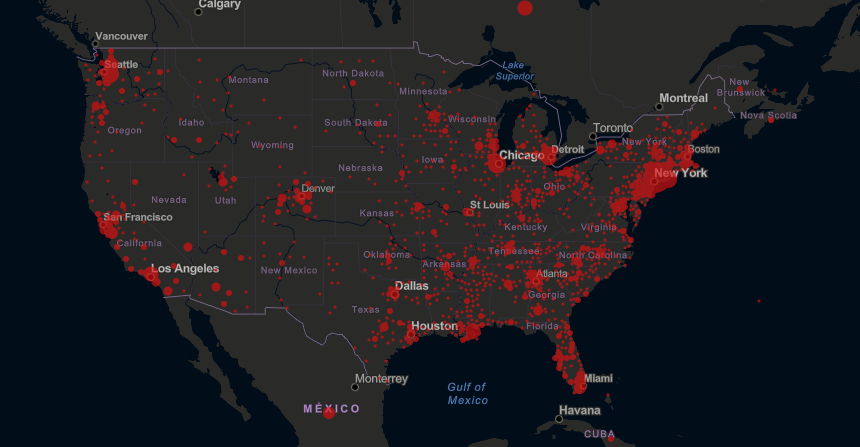

Right now, the US is getting spun up with their COVID testing.

That means we're going to see a deluge of "bad" numbers...

First will be the COVID numbers, which will continue to ramp higher.

Second will be economic data like unemployment. It’s going to be morbidly hilarious.

Third will be earnings guidance. We all know they’re coming.

But the market LOVES data. Those nerds love numbers that can go into spreadsheets. And when the risks become better modeled, then they can get priced in.

Liquidity comes back.

And once the bad news starts getting priced in, markets can bounce.

Fuel to The Fire

Here’s where we get into the “lucky guess” side of things.

At some point, the fever breaks.

Shutdowns will reverse. Bars will reopen. People will get back to work.

And you will see a righteous fury from the American consumer.

Those postponed trips to Disney? Rescheduled.

Trading in for a new car? Anything to feel normal.

A new ipad with your bailout money? Sure, because you’re already back at work.

Cinco de Mayo will be wild.

The economic recovery won’t be “W” shaped.

It won’t be “V” shaped.

It will be “Y” shaped. We’re at an asymptote where things are pricing in "zero" and will come back online with the same speed.

And all the ugly earnings guidance? Yes, next quarter's gonna be ugly. Probably the quarter after that.

At some point, these companies will guide back higher because we bought things as a big “fuck you” to the quarantine we had to endure.

My Market Bottom Prediction

Here’s where I stick my neck out.

Again, we don't know when the "low" will be until it happens. And we'll call the low the lowest value in a 10 day window.

The market will not retest its lows.

That’s a pretty bold claim, and it runs in the face of many things we know about traditional market bottoms. I should know because I created a Field Guide to these market structures.

It’s very normal for markets to retest the lows. Go look at 2008, 2011, 2015… all retested the lows after a very high volatility range.

This time, it will be different.

There are very large firms blowing up. Ronin Capital is the first to fall. Other rumors are Brdigewater and Citadel are getting smoked. Way too many smart people tried to short volatility when it was overbought, and that move went open loop.

Once the leverage clears out of the system, you no longer have that liquidity to the downside. Panicked sellers stop hitting the bid.

Instead, we will see the offer on the market continue to lift. It will be with lower volume... there won't be a lot of people buying aggressively... the offer will continue to ratchet higher.

Overeager shorts will play for the next rollover... and it won't come. The leverage is gone, until funds decide to get cute and chase.

Soon you’ll see funds forcing their way back into stocks as the worst is over.

COVID fears will not go away, for a time.

There will be a risk of another event in Q4, but this time the US government overprepare and overreact.

And like clockwork, the same people who hated the Fed from the past decade will continue to hate the Fed. They’ll blame the rally on liquidity and how it isn’t sustainable. Have fun with that.

Is it possible I look like an idiot with this market call? Sure.

Wouldn't be the first time.

There could be enough negative reflexivity to keep earnings muted. More unwinds could happen.

Remember, bear market rallies are as aggressive as the selloffs. And the market participants that demanded liquidity during the selloff won't demand it again.

WHEN Will The Market Bottom?

That's the real question, isn't it?

As I write this, the Fed has promised an unlimited backstop on credit facilities.

The US Congress is (shocker) dragging its feet to push through a fiscal response.

You'd think that we will bounce on that news, right?

I don't think so. I think it will come on some random day not driven by newsflow.The markets will bottom before US COVID numbers peak.

Analysis and trading are not the same thing. As a trader, you don't have to nail the exact bottom to make profits in this market... opportunities will exist 3 months and 3 years from now.

Here's what I'm telling myself...

1. Don't short the first countertrend bounce.

2. Not all stocks are going to make it out of this, so index bets are simpler here.

3. Short vol is now a less crowded space, and will be for a long time.

2. Not all stocks are going to make it out of this, so index bets are simpler here.

3. Short vol is now a less crowded space, and will be for a long time.

Nessun commento:

Posta un commento